Financial management is a critical aspect of running any enterprise, and businesses in Saudi Arabia can greatly benefit from the use of accounting software in Saudi Arabia. With the advancements in technology, a variety of ERP accounting software options are now available in the market that cater to the diverse needs of businesses in the region.

One of the popular options is simple accounting software, which provides a user-friendly interface and basic accounting features that are easy to use and understand. This type of software is particularly useful for small businesses that don't require advanced accounting features.

Another useful tool for businesses in the UAE is online HR management software. This software enables companies to streamline their HR processes, such as employee onboarding, payroll management, and performance evaluation. By automating these tasks, businesses can save time, reduce errors, and improve employee engagement.

Online stock management software is another essential tool that helps businesses manage their inventory levels efficiently. This software provides real-time insights into stock levels, enables businesses to track inventory movements, and optimizes inventory levels to prevent overstocking or stockouts.

When it comes to selecting the best accounting software in UAE, businesses have numerous options to choose from. The software should offer features that cater to the specific needs of the business, such as budgeting, invoicing, and financial reporting.

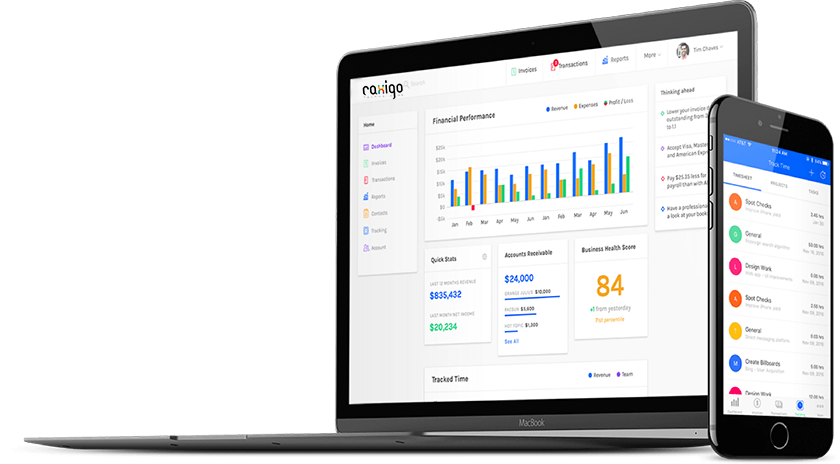

Cloud accounting software is another popular option that enables businesses to access their financial data from anywhere and at any time. This type of software provides real-time insights into financial performance, enhances collaboration, and simplifies financial management.

Finally, enterprise resource planning (ERP) accounting software is a comprehensive solution that integrates all aspects of financial management, including accounting, inventory management, and HR management. This type of software is particularly useful for large businesses that require advanced financial management features.

In conclusion, the use of accounting software can greatly benefit businesses in Saudi Arabia, and businesses can choose from a variety of software options that cater to their unique needs. Simple accounting software, online HR management software, online stock management software, the best accounting software, cloud accounting software, and ERP accounting software are all valuable tools that can help businesses streamline their financial management and achieve better financial outcomes.

Another important consideration for businesses in the UAE when selecting accounting software is the ability to integrate with other business applications. For instance, some software may offer integrations with customer relationship management (CRM) software or project management tools, which can help businesses streamline their processes and improve efficiency.

In addition to improving financial management, accounting software can also help businesses stay compliant with local regulations and tax laws. Many accounting software solutions are designed to comply with local tax laws and regulations, which can help businesses avoid costly fines and penalties.

UAE can benefit from accounting software's ability to provide real-time insights into financial performance. By monitoring key financial metrics such as cash flow, revenue, and expenses, businesses can identify potential issues early and make informed decisions to improve their financial outcomes.Overall, the use of accounting software can greatly benefit businesses in the UAE, regardless of their size or industry. With the various options available, businesses can select the software that best suits their needs and helps them achieve their financial goals.

One of the key advantages of using accounting software in the UAE is the ability to save time and reduce errors. By automating many manual accounting processes such as data entry, invoicing, and financial reporting, businesses can reduce the risk of human error and free up time for other important tasks.

Another benefit of accounting software is the ability to generate accurate financial reports quickly and easily. Many software solutions provide customizable templates for reports such as balance sheets, income statements, and cash flow statements, which can be generated with just a few clicks. This can be particularly useful for businesses that need to generate financial reports for investors or regulatory bodies.

Cloud accounting software is becoming increasingly popular in the UAE, as it allows businesses to access their financial data from anywhere with an internet connection. This can be particularly useful for businesses with remote teams or multiple locations. Cloud accounting software also provides an added layer of security, as data is stored securely in the cloud rather than on a local computer.

Accounting software can help businesses improve their decision-making processes by providing real-time insights into financial performance. By monitoring key financial metrics on a regular basis, businesses can identify trends, spot potential issues early, and make informed decisions to improve their financial outcomes.

Accounting software is a powerful tool that can help businesses in the UAE improve their financial management, save time, reduce errors, and make better-informed decisions. With the variety of software solutions available, businesses can select the software that best meets their needs and helps them achieve their financial goals.