Online Accounting Software in UAE, Oman, Saudi, Qatar" refers to the importance of online accounting software in managing finances for businesses in the Gulf region. The title highlights the benefits of using online accounting software to streamline financial management processes in countries such as the UAE, Oman, Saudi Arabia, and Qatar. By automating financial tasks and providing accurate financial data, online accounting software can help businesses in the Gulf region make informed decisions, increase efficiency, and improve their overall financial management.

The Gulf region is a fast-growing business hub, and many companies in this region face unique challenges when it comes to financial management. These challenges include navigating complex tax systems, managing multi-currency transactions, and complying with local regulations.

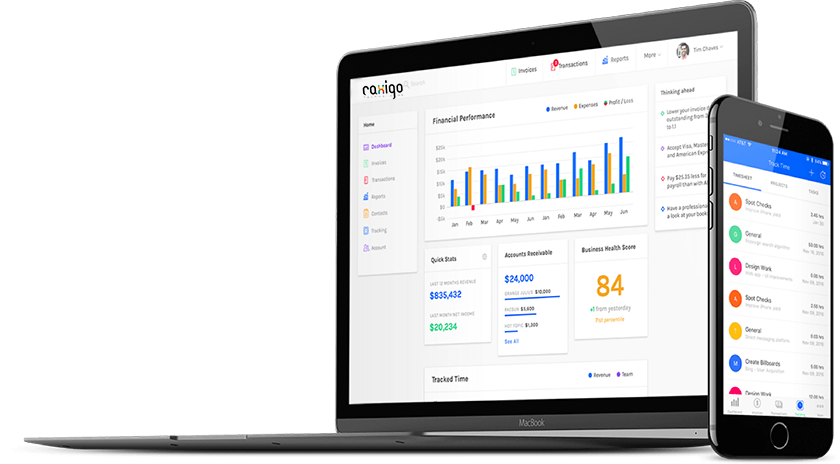

Online accounting software can help businesses in the Gulf region address these challenges by providing a user-friendly platform for managing finances. Some key features of online accounting software include automated bookkeeping, invoice management, expense tracking, and financial reporting. These features can help businesses save time, reduce errors, and gain better control over their finances.

In addition to these basic features, many online accounting software providers also offer more advanced features such as payroll management, inventory management, and integrations with other business software. This can help businesses in the Gulf region streamline their operations and improve overall efficiency.

"Efficient Financial Management in the Gulf Region: Online Accounting Software in UAE, Oman, Saudi, Qatar" highlights the importance of online accounting software in helping businesses in the Gulf region overcome the unique challenges of financial management. By adopting online accounting software, businesses in the Gulf region can gain a competitive advantage, improve their financial management processes, and position themselves for growth in the dynamic business landscape of the region.

To elaborate further on the topic, online accounting software in the Gulf region has become increasingly popular in recent years due to the rise of digitalization and the need for more efficient financial management solutions. The software is cloud-based, which means that businesses can access their financial data from anywhere at any time, making it ideal for companies with multiple branches or remote teams.

Moreover, online accounting software in the Gulf region is designed to comply with local tax regulations and accounting standards. This is particularly important as each country in the region has its own set of financial regulations and laws, and businesses that do not comply can face penalties or legal issues.

Another key advantage of online accounting software in the Gulf region is the ability to manage multi-currency transactions. As many businesses in the region operate across borders, having a system that can handle different currencies and exchange rates is crucial. Online accounting software can automatically convert currencies, track exchange rates, and provide accurate financial data.In conclusion, the title "Efficient Financial Management in the Gulf Region: Online Accounting Software in UAE, Oman, Saudi, Qatar" highlights the importance of online accounting software in addressing the unique challenges of financial management in the Gulf region. By providing a user-friendly platform for managing finances, complying with local regulations, and handling multi-currency transactions, online accounting software can help businesses in the region improve their efficiency, productivity, and overall financial health.

The management of human resources and stock are critical components of any business, regardless of location. In the Gulf region, which includes Qatar, UAE, Oman, and Saudi Arabia, there are several unique challenges that businesses face when managing these functions. Here are some key points about HR management and stock management in these countries:

HR Management in Qatar, UAE, Oman, and Saudi Arabia:

Stock Management in Qatar, UAE, Oman, and Saudi Arabia:

In order to manage these challenges, many businesses in the Gulf region are turning to software solutions. For example, HR management software can help businesses automate tasks such as payroll, benefits administration, and performance reviews. Stock management software can help businesses track inventory levels, forecast demand, and manage the supply chain. By adopting these solutions, businesses in the Gulf region can improve their efficiency, productivity, and overall performance.