Accounting software is an important tool for businesses in Saudi Arabia to manage their financial records efficiently and effectively. Cloud accounting software has become increasingly popular due to its accessibility and convenience. These software solutions are hosted on the internet, allowing users to access their financial data from anywhere with an internet connection.

For businesses that require a simpler accounting software solution, there are options available as well. Simple accounting software in Saudi Arabia is designed for small businesses with basic accounting needs. These software solutions typically offer features such as invoicing, expense tracking, and basic financial reporting.

When selecting an accounting software solution in Saudi Arabia, it's important to consider ZATCA approval. ZATCA (Zakat, Tax and Customs Authority) is responsible for administering taxes and ensuring compliance with tax laws in Saudi Arabia. ZATCA approved software in Saudi Arabia means that the software meets the standards set by the authority, ensuring that users are able to manage their financial records in accordance with tax laws.

Accounting software solutions available in Saudi Arabia, including cloud accounting software, simple accounting software, and ZATCA approved software. Businesses should carefully evaluate their needs and select a software solution that meets their specific requirements, including compliance with tax laws.

Accounting software is a type of computer software that enables businesses to record and manage their financial transactions. It can help with tasks such as invoicing, expense tracking, financial reporting, and tax compliance. By automating these processes, accounting software can save businesses a significant amount of time and effort compared to manual record-keeping.

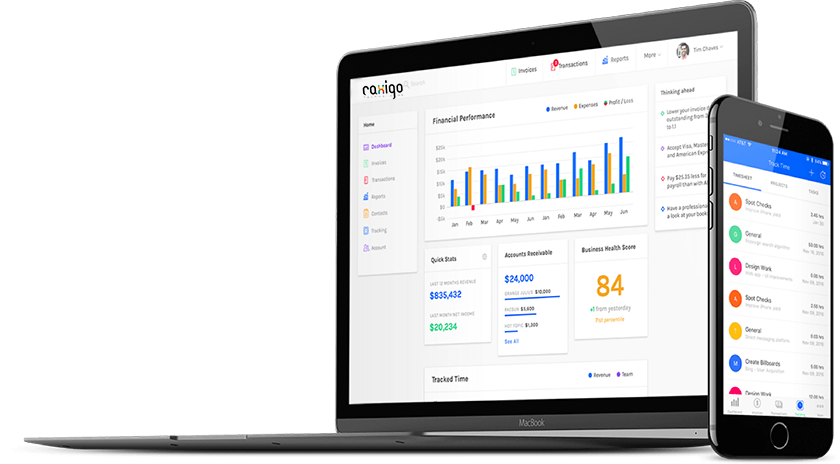

Cloud accounting software, also known as online accounting software, is a type of accounting software that is hosted on the internet. This means that users can access their financial data from anywhere with an internet connection, making it very convenient for businesses with multiple locations or remote workers. Cloud accounting software also offers automatic updates and backups, reducing the risk of data loss or software obsolescence.

Simple accounting software is a type of accounting software that is designed for businesses with basic accounting needs. It typically includes features such as invoicing, expense tracking, and basic financial reporting, but may not have more advanced features such as inventory management or payroll processing. Simple accounting software can be a good choice for small businesses with limited financial resources or accounting expertise.

ZATCA approved software is software that has been approved by the Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia. ZATCA is responsible for administering taxes and ensuring compliance with tax laws in the country. By using ZATCA approved software, businesses can ensure that their financial records are in compliance with local tax laws and regulations. This can help to avoid penalties and other legal issues.

When selecting an accounting software solution, businesses should consider factors such as their specific accounting needs, budget, and level of expertise. They should also ensure that any software they choose is compatible with other tools they use, such as payroll software or bank accounts. Finally, they should ensure that the software they choose is ZATCA approved if they operate in Saudi Arabia, to ensure compliance with local tax laws.

Accounting software can also help businesses manage their cash flow, track expenses and income, and generate financial reports such as balance sheets and income statements. Some accounting software solutions also offer features such as budgeting, forecasting, and project management tools.

Cloud accounting software has several advantages over traditional accounting software solutions. For example, because it is hosted on the internet, it can be accessed from any device with an internet connection, including desktops, laptops, tablets, and smartphones. This can be especially useful for businesses with employees who work remotely or travel frequently.

Cloud accounting software is that it is typically more affordable than traditional accounting software solutions. Instead of paying a large upfront fee for software and hardware, businesses can pay a monthly or yearly subscription fee for access to the software. This can make accounting software more accessible to small businesses with limited budgets.

Simple accounting software can also be a good choice for businesses that do not require advanced accounting features. It is typically easier to use and less expensive than more complex software solutions, making it a good choice for small businesses or those with limited accounting expertise.

ZATCA approved software is important for businesses operating in Saudi Arabia, as it ensures compliance with local tax laws and regulations. ZATCA-approved software must meet certain standards, such as the ability to generate tax reports and provide electronic invoicing. By using ZATCA approved software, businesses can avoid penalties and other legal issues related to tax compliance.

Accounting software is an essential tool for businesses of all sizes in Saudi Arabia. By automating financial processes and providing accurate and timely financial data, accounting software can help businesses make better financial decisions and stay on top of their financial health. When selecting an accounting software solution, businesses should consider their specific needs, budget, and expertise, and ensure that the software they choose is compatible with other tools they use and is ZATCA approved if operating in Saudi Arabia.

Integration with other software: Many businesses use other software tools such as payroll, inventory management, or CRM software. When choosing accounting software, businesses should ensure that it integrates with the other software they use to avoid manual data entry and streamline financial processes.

Security: With cloud accounting software, financial data is stored on servers owned by the software provider. This means that businesses must trust the provider to keep their data safe and secure. Businesses should choose a software provider that has strong security measures in place, such as encryption and secure backups.

Support and training: Accounting software can be complex, and businesses may require support or training to use it effectively. When choosing accounting software, businesses should consider the level of support and training offered by the provider, such as online tutorials, documentation, and customer support.

Scalability: As businesses grow and their accounting needs become more complex, they may require more advanced accounting software features. When choosing accounting software, businesses should ensure that it can scale up to meet their future needs without requiring a complete software change.

User interface: Accounting software should be easy to use and understand for all users, regardless of their accounting expertise. Businesses should choose software with a user-friendly interface and clear navigation to ensure that all users can use it effectively.In summary, businesses in Saudi Arabia have a range of accounting software options available to them, including cloud accounting software, simple accounting software, and ZATCA approved software. When choosing accounting software, businesses should consider their specific needs, budget, expertise, and compliance with local tax laws. Additionally, they should consider integration with other software, security, support and training, scalability, and user interface.