Online accounting software in UAE refers to software applications that allow businesses in the United Arab Emirates (UAE) to manage their financial transactions and accounting software in UAE processes through a web-based platform. This type of software is increasingly popular among businesses in the UAE due to its convenience, accessibility, and affordability.

One important feature of online accounting software UAE is stock management software. This allows businesses to keep track of their inventory levels in real-time, enabling them to optimize their stock management in UAE levels and prevent stockouts or overstocking. Online stock management software in UAE is a specific type of online accounting software in UAE that is designed specifically for managing inventory levels.

Some of the benefits of using online accounting software in the UAE include increased efficiency and accuracy in financial reporting, improved cash flow management, and easier compliance with local tax laws. Additionally, online accounting software in UAE can be accessed from any device with an internet connection, making it a flexible and convenient option for businesses with multiple locations or remote workers. Online accounting software in UAE with stock management software in UAE features can help businesses in the UAE to streamline their financial processes and improve their bottom line. By using these tools, businesses can gain better insight into their finances and make more informed decisions about how to manage their inventory and cash flow.

Online accounting software in UAE typically includes a range of features and functionalities beyond just stock management software in UAE. These may include:

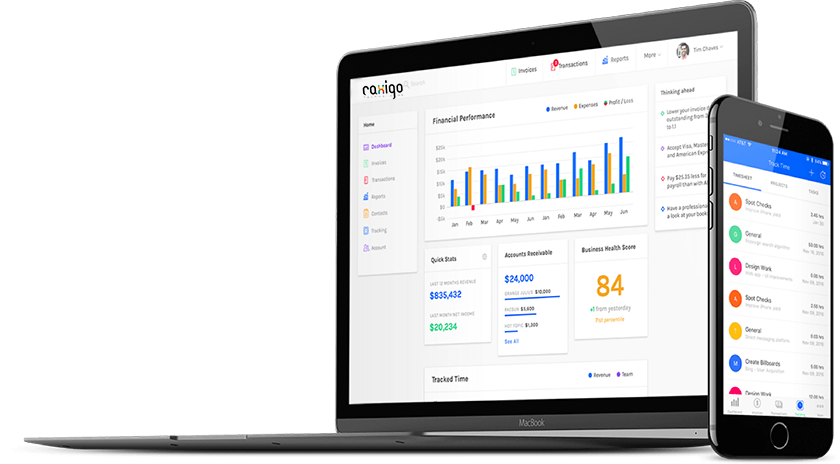

Invoicing: With online accounting software in UAE, businesses can easily create and send invoices to customers, track payment statuses, and automate payment reminders.

Financial reporting: Online accounting software in UAE often provides a variety of financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports can help businesses track their financial performance and make informed decisions.

Multi-currency support: As UAE businesses often deal with international clients, many online accounting software in UAE platforms support multiple currencies, allowing businesses to manage their finances in different currencies and convert them as needed.

Collaboration: Online accounting software in UAE allows for multiple users to access and update financial information, making it easier for teams to collaborate and stay on the same page.

Online accounting software in UAE with stock management software in UAE capabilities is a valuable tool for businesses in UAE to manage their finances more effectively, save time, and reduce errors. With a variety of features and functionalities available, businesses can choose a online accounting software in UAE solution that meets their unique needs and goals.

Online accounting software in UAE may also offer additional features and functionalities depending on the provider. Some other popular features that businesses may find useful include:

Budgeting and forecasting: Online accounting software in UAE may include budgeting and forecasting tools that allow businesses to create and track their financial goals over time.

Payroll management: Online accounting software in UAE platforms may offer payroll management features, allowing businesses to calculate employee salaries, taxes, and other payroll-related expenses.

Time tracking: Online accounting software in UAE may include time tracking tools that enable businesses to track employee time, billable hours, and project expenses.

Mobile accessibility: Online accounting software in UAE platforms offer mobile apps that allow businesses to access their financial data on-the-go, from any device.

Integration with other software: Online accounting software in UAE can often integrate with other business software, such as CRM software, project management tools, and e-commerce platforms.

Online accounting software in UAE can help businesses in UAE to save time and improve their financial management processes. With a wide range of features and functionalities available, businesses can choose a software solution that fits their specific needs and goals, and provides a solid foundation for their financial success.