Accounting software refers to a type of computer software that is designed to help businesses manage their financial transactions, including billing and invoicing, stock management, and payroll management. In the UAE, there are several options for simple accounting software that can help businesses keep track of their finances more efficiently.

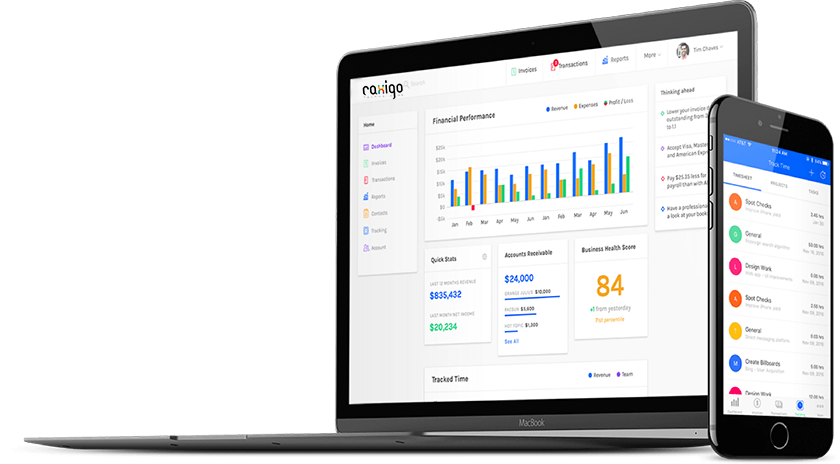

These accounting software solutions often offer features such as automated billing and invoicing, inventory management, and payroll management. They can also help businesses generate financial reports, manage accounts payable and accounts receivable, and track expenses and revenue.

Billing software in UAE would likely be an accounting software solution that focuses on streamlining the billing process for businesses operating in the UAE. Similarly, a simple accounting software in UAE would be an accounting software solution that is designed for small and medium-sized businesses in the UAE, and which offers a straightforward and user-friendly interface.

Online HR management software in UAE would be a different type of software solution that focuses specifically on managing employee information, such as tracking time and attendance, managing benefits and compensation, and handling employee records. Finally, an online stock management software in UAE would be an accounting software solution that is designed to help businesses manage their inventory and stock levels, ensuring that they always have the products they need to meet customer demand.

Accounting software solutions can be extremely valuable for businesses operating in the UAE, as they help to automate and streamline financial processes, while also providing valuable insights into business performance and financial health.

Accounting software can offer several benefits to businesses beyond just streamlining financial processes. Here are a few key advantages of using accounting software in the UAE:

Improved accuracy: Accounting software can help reduce errors and inaccuracies in financial data by automating calculations and reducing the need for manual data entry.

Time-saving: By automating financial processes like invoicing, billing, and payroll management, businesses can save time and focus on other areas of their operations.

Financial insights: Accounting software can generate detailed financial reports that can provide valuable insights into business performance, helping businesses to make informed decisions about their operations.

Better compliance: Accounting software can help businesses stay compliant with local tax laws and regulations by providing accurate and up-to-date financial data.

Scalability: As businesses grow, accounting software can help manage the increasing complexity of financial processes, making it easier to scale operations without sacrificing accuracy or efficiency

Accounting software can be a valuable tool for businesses in the UAE, helping to streamline financial processes, reduce errors, and provide valuable insights into business performance. With a wide range of accounting software solutions available, businesses can find the right software to meet their specific needs and help them succeed.

Improved cash flow management: Accounting software can help businesses track their accounts payable and accounts receivable, making it easier to manage cash flow and ensure that bills are paid on time.

Increased efficiency: By automating financial processes, accounting software can help businesses operate more efficiently, freeing up time and resources to focus on other areas of the business.

Enhanced security: Accounting software can help keep financial data secure by storing it in a central location and restricting access to authorized users.

Easier collaboration: Accounting software can enable multiple users to access and update financial data simultaneously, making it easier for teams to collaborate on financial tasks.

Better forecasting: By analyzing historical financial data, accounting software can help businesses make more accurate predictions about future financial performance, enabling them to make more informed decisions about their operations.

Accounting software can offer several benefits to businesses in the UAE, from streamlining financial processes and improving accuracy to providing valuable financial insights and enhancing collaboration. As businesses continue to grow and operate in increasingly complex financial environments, online accounting software can help them stay competitive and achieve their financial goals.

Few more advantages of using accounting software in the UAE:

Reduced costs: Accounting software can help businesses reduce costs associated with hiring and training accounting staff, as well as reducing the need for manual data entry and other time-consuming tasks.

Customization: Many online accounting software solutions offer a range of customization options, allowing businesses to tailor the software to their specific needs and preferences.

Cloud-based access: Cloud-based accounting software solutions allow businesses to access financial data from anywhere with an internet connection, making it easier to work remotely or on-the-go.

Improved decision-making: Online accounting software can provide real-time financial data, allowing businesses to make informed decisions about their operations, such as identifying areas of the business that are most profitable or identifying areas where costs can be reduced.

Integration with other software: Many online accounting software solutions can integrate with other business software, such as inventory management or customer relationship management (CRM) software, making it easier to manage all aspects of the business in one place.

Accounting software can provide several benefits to businesses in the UAE, from reducing costs and improving decision-making to providing customized solutions and integrating with other business software. With the right online accounting software solution, businesses can manage their finances more efficiently and effectively, helping them to achieve their financial goals and grow their operations.