Online accounting software UAE refers to digital tools and solutions designed to assist businesses and individuals in managing their financial transactions, recordkeeping, and other accounting tasks.

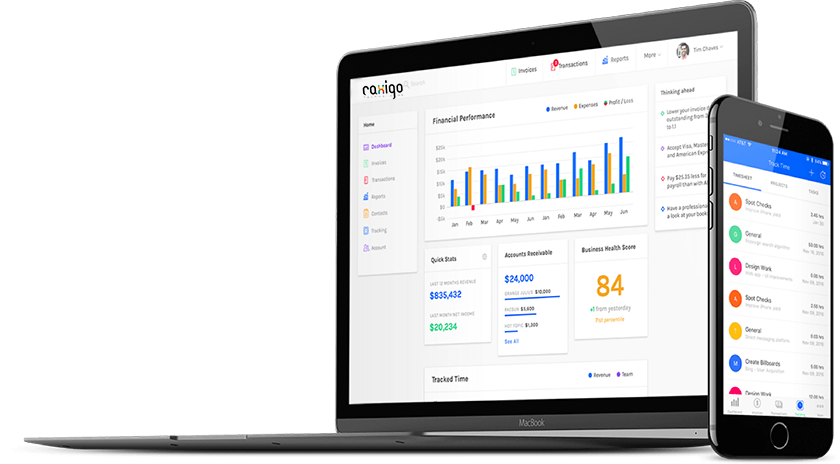

Online accounting software in UAE: Online accounting software in the UAE refers to cloud-based solutions that allow users to access their accounting data and perform financial tasks over the internet. It eliminates the need for local installations and provides the convenience of accessing financial information from anywhere with an internet connection. Businesses in the UAE can securely manage their accounting processes, including invoicing, expense tracking, payroll, and financial reporting, using online accounting software UAE.

Online stock management in UAE: Online stock management, or inventory management, in the UAE involves using digital tools to efficiently track and control stock levels, monitor product movements, automate reordering processes, and generate inventory reports. By utilizing online stock management solutions, businesses in the UAE can optimize inventory control, reduce costs, improve order fulfillment, and make data-driven decisions to streamline their supply chain operations.

Stock management software in UAE: Stock management software refers to dedicated solutions designed to manage inventory-related tasks. In the UAE, stock management software helps businesses track stock levels, monitor product movements, automate reordering processes, and generate comprehensive inventory reports. These software solutions enable UAE-based businesses to enhance their inventory control, reduce costs, improve efficiency, and optimize their overall supply chain operations.

Billing software in UAE: Billing software streamlines the invoicing process for businesses in the UAE. It automates the creation and distribution of invoices, tracks payment status, and generates reports for financial analysis. Billing software in the UAE is commonly used by businesses to issue invoices to customers, record payment receipts, and manage accounts receivable. It integrates with accounting systems to ensure accurate financial records and streamline the billing cycle.

Simple accounting software in UAE: Simple accounting software refers to user-friendly solutions designed for small businesses or individuals with basic accounting needs. In the UAE, simple accounting software provides essential features such as recording income and expenses, managing invoices, tracking bank transactions, generating financial reports, and facilitating tax compliance. This type of software aims to provide an intuitive and easy-to-use interface, making it accessible to non-accounting professionals in the UAE.

Online HR management software in UAE: Online HR management software focuses on automating and streamlining various human resources processes within an organization. In the UAE, this software often integrates HR functionalities with accounting modules to provide a comprehensive solution. It enables UAE-based businesses to manage employee information, track attendance, process payroll, handle leave and benefits administration, and generate HR reports. Integrating HR management accounting software ensures efficiency, accuracy, and compliance in managing the workforce.

Best accounting software in UAE: Best accounting software refers to highly regarded and top-rated software solutions that offer comprehensive features and functionalities for efficient financial management. In the UAE, the best accounting software encompasses a range of solutions that cater to various business sizes and industries. These software solutions provide robust features such as invoicing, expense tracking, financial reporting, inventory management, and integration capabilities. They are recognized for their reliability, user-friendliness, and ability to meet the specific accounting needs of businesses in the UAE.

Cloud accounting software in UAE: Cloud accounting software, in the context of the UAE, refers to accounting solutions hosted on remote servers and accessed through the internet. It allows businesses to securely store their financial data in the cloud