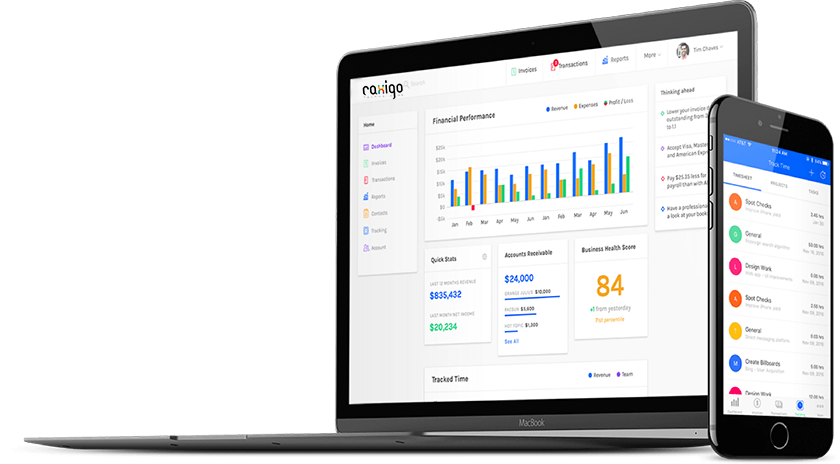

ERP (Enterprise Resource Planning) accounting software refers to a type of online accounting software solution specifically designed to manage accounting and financial processes within an organization. In the context of Qatar, ERP accounting software Qatar is utilized by businesses and companies in Qatar to streamline their financial operations, enhance efficiency, and ensure compliance with local accounting regulations.

Here are some key features and functionalities typically found in ERP accounting software Qatar:

General Ledger: The ERP accounting software provides a central repository to record and track financial transactions, including accounts payable, accounts receivable, payroll, and general journal entries. It allows for accurate simple bookkeeping software and generates financial statements like balance sheets, income statements, and cash flow statements.

Accounts Payable: This module manages the company's payable accounts, including recording and tracking invoices, managing vendor information, processing payments, and maintaining a comprehensive audit trail.

Accounts Receivable: The online accounting software Qatar helps manage the company's receivables, including generating and tracking customer invoices, recording payments, managing customer credit limits, and tracking outstanding balances.

Financial Reporting: ERP accounting software offers robust reporting capabilities, allowing users to generate customized financial reports, performance indicators, and analytics. It helps in making informed financial decisions and meeting regulatory reporting requirements.

Budgeting and Forecasting: This module assists in creating and managing budgets, enabling businesses to plan and track their financial performance against predefined targets. It also facilitates forecasting future financial outcomes based on historical data and trends.

Fixed Assets Management: ERP accounting software allows organizations to manage and track their fixed assets, including acquisition, depreciation, maintenance, and disposal. It helps in maintaining accurate asset records and calculating depreciation expenses.

Bank Reconciliation: The online accounting software automates the process of reconciling bank statements with the company's financial records, ensuring accuracy and identifying any discrepancies or errors.

Tax Management: ERP accounting software incorporates tax management functionalities, including calculating and tracking various taxes applicable in Qatar, such as value-added tax (VAT), withholding tax, and corporate income tax. It helps businesses stay compliant with local tax regulations.

Multi-Currency Support: Qatar being an international business hub, ERP accounting software often supports multiple currencies, enabling businesses to conduct transactions and manage accounts in different currencies.

Integration and Scalability: ERP accounting software can integrate with other systems within an organization, such as inventory management, sales, and purchasing, to streamline data flow and eliminate redundant data entry. It also offers scalability to accommodate the growing needs of the organization as it expands.

ERP accounting software in Qatar, businesses can gain better control over their financial processes, reduce manual errors, improve data accuracy, enhance decision-making capabilities, and ensure compliance with local accounting regulations.