In today's dynamic Saudi Arabian business environment, having the right accounting software is not a luxury; Given the growing interest in VAT compliance and the need for effective financial management, choosing the best software can be a game changer. But with so many options, where do you start? Important factors to consider when choosing Best accounting software in Saudi:

VAT Compliance: Make sure the software complies with the new VAT rules in Saudi Arabia, including electronic solvency. Discover the features that calculate and refund VAT. Do you need inventory management, project tracking, payroll or advertising resources? Choose a solution with flexible plans to accommodate future expansion. Look for software that is intuitive and easy to navigate. User experience that enables the software to provide full Arabic support, including billing, advertising and customer interaction. Choose Arabia table for all your business needs:

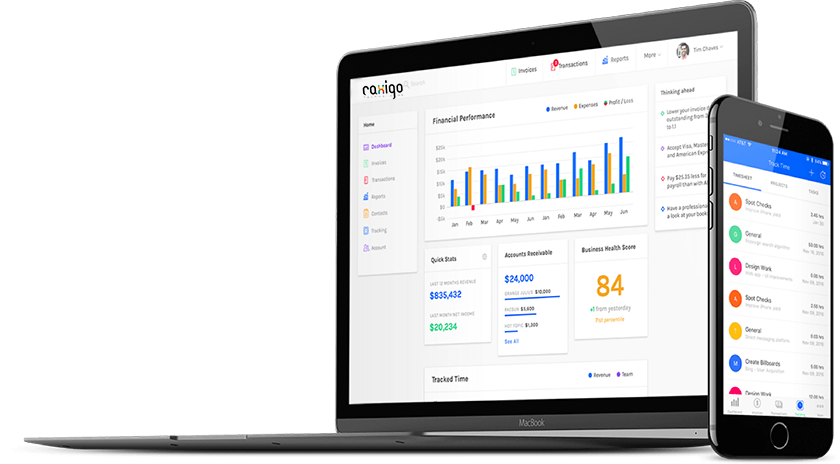

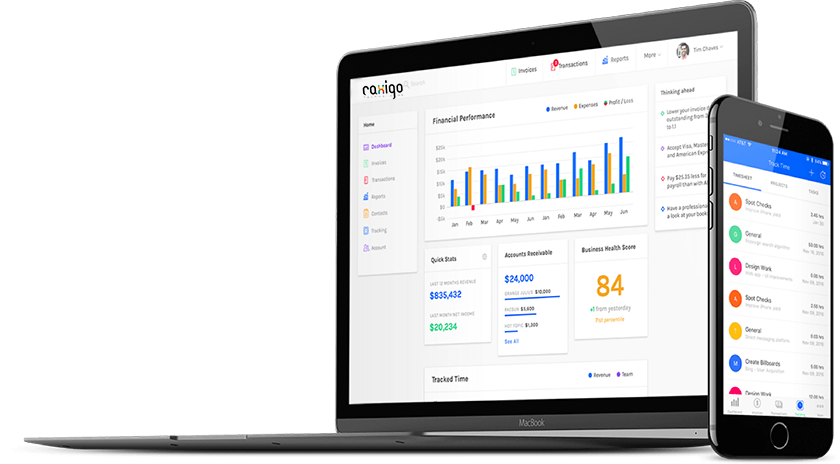

QuickBooks: QuickBooks is a popular choice for small and medium-sized businesses, offering a user-friendly, functional overview and VAT compliance. It has invoicing, expense tracking and easy reporting features. Track and report ads. It provides seamless integration with other Zoho applications. It has advanced features such as budgeting, forecasting and accounting. Study Arabic. It provides functions such as bank reconciliation, inventory management, and payroll processing. Here are some additional tips to ensure the success of using best accounting software in saudi:

Invest in training: Provide your employees with trained skills to properly use their chosen software. Check your data for errors and make sure all changes have been recorded correctly. Assistance with installation and ongoing support. Remember, the best accounting software is more than a tool; It is your strategic partner on your journey to financial success.