Accounting data were previously kept on a desktop, and day-to-day bookkeeping required someone to be present in the office to record transactions, pay bills, and invoice clients.

Bookkeeping duties were frequently put off until the end of the week, the month, or even the year. This occurred as a result of business owners giving their customers' needs a higher priority than devoting hours to accounting and bookkeeping. Who was to blame for them?

But when tax season arrived, all of that waiting was exposed. Personal and corporate spending were mixed up, expenses were mislabeled or altogether overlooked, and bank accounts weren't reconciled to catch mistakes as they happened.

Because inaccurate financial statements couldn't provide precise tax predictions, tax planning was pointless. Prior to preparing a tax return, their accountants spent endless (expensive) hours simply fixing mistakes.

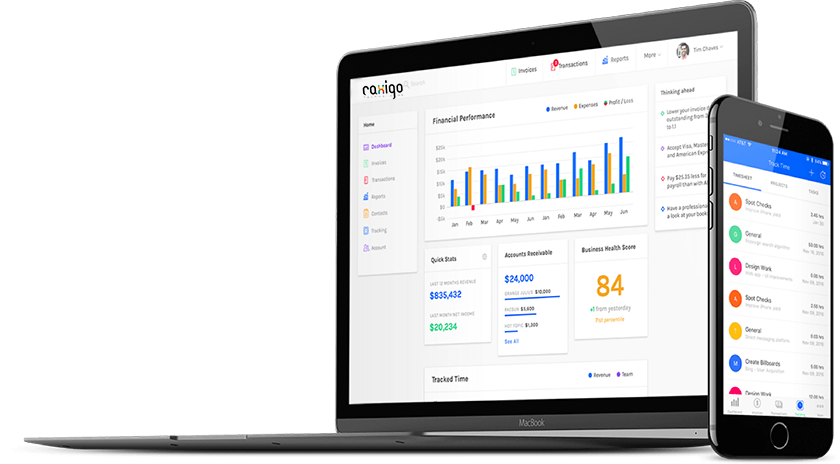

Fortunately, cloud accounting software has introduced a wide range of tools and technology that can lessen the hassles associated with keeping track of invoices, receipts, and bills.

Not just for small business owners, but for their accounting and tax experts as well, cloud technology has changed the accounting industry. Let's look at five ways that cloud accounting software makes your life easier.

Record Your Business Expenses Quickly

Implement quick and easy software updates

The previous method of using accounting software required investing in a pricey software package and putting it on a computer. Every year, when a new version of the programme was released, small business owners had to decide whether to set aside money for it or stick with an old, frequently unsupported, version.

The company would need to buy more licences if it wished to provide different personnel access to the accounting data. Additional users made upgrades difficult because new releases had to be loaded separately on each system, which came at a cost of numerous licences.

The procedure of updating software has been made incredibly simple by cloud accounting. You are no longer responsible for software installation, updating to new versions, or data backup. You can only use a web browser or an app to access the software. Instead of making a sizable upfront investment, the software provider manages upgrades, backups, and security so you don't need to recruit your own IT staff. All of this is done for a reasonable monthly price.

Use Add-on Features to Make the Experience More Seamless

You probably use a variety of apps and software programmes to organise your accounting. Are there any applications that work well together? Since they make it simple to move data from one application to another, integrated apps (or add-ons) can help you save a lot of time and money.

Consider the way you monitor your business travel. The traditional method entailed keeping a paper journal in your glove compartment and recording your mileage and intended use for each trip. These days, you can track those kilometres automatically using apps.Although it is practical, it is much more beneficial when those apps work with your accounting programme. In the absence of integration, you would need to keep in mind to log into your mileage tracking programme each month, record your mileage, log into your accounting programme, and enter a cost for your miles multiplied by the IRS standard mileage rate.

Who truly spends the time each month doing that? It's more likely that you'd postpone the chore until the end of the year when you're frantically gathering all of your other tax records.

Of all, keeping track of mileage is just one of the time-saving benefits of integrated applications. Online payment acceptance, payroll, time tracking, scheduling, sales tax reporting, project management, and other issues can all be solved. The annoying administrative duties that used to take a small business owner hours now only take minutes with these add-ons.

Work together with your clients and team

With cloud accounting, sharing data with your accountant or tax preparer is simple. This lessens the usual back and forth process while increasing security and collaboration. Let's examine a case in point.

Imagine you are a contractor looking to buy a new piece of machinery. You're unsure if it's the best course of action for your company. Should you buy or rent? Will there be a problem with cash flow due to the monthly payments?

You would probably call your accountant to explain the situation if you were still using desktop accounting software. Your year-to-date financials would be requested by your accountant. Either you would have to print them out and deliver them by hand, or you would have to email them—hopefully you would remember to encrypt that email for security.

The accountant would analyse your financial records after receiving them. They could require more information or have more queries on the price of the item and your alternatives for leasing or financing. Your accountant will likely need at least a day or two to run the calculations and provide you the details you need to make a choice.

Let's now think about how that situation would work using cloud accounting software. While you are on the phone with the accountant, he or she can log into the programme.

Your information is quickly reviewed by the accountant, who can immediately show your year-to-date net income. After they've had the conversation, they'll most likely still need to phone you.

The same teamwork can take place whether you're thinking about making an investment in machinery, agreeing to a new customer contract, buying real estate, or recruiting a new employee. You have quick, safe access to the up-to-date financial data that your accountant can utilise to help you make wiser decisions.

Consider switching to the cloud if you're currently using a spreadsheet or a typical desktop accounting programme for your small business. It won't merely improve the effectiveness of your money management. You'll get your time back as a result. In this manner, you can begin concentrating on your primary business objectives and raise the long-term success of your organisation.